Islam provides us guidance regarding the types of companies that can be formed if two of more people want to enter into business together. The capitalist model of companies contradicts the conditions laid down by the Shari’ah and is therefore not permissible for Muslims to invest in.

In Islam, 5 types of companies are allowed. They are:

1. The Company of Equals (Al-’Inan): this is where both partners put their money into a business and work with it. Both partners would have the right to buy and sell and take the company forward, hence all partners are all equal in their disposal.

2. The Company of Bodies (Al-Abdan): this is where two or more people come together with their skills such as a consultant, doctor or craftsmen. Although they use their money, the skill they have is what constitutes the basis of the company.

3. The Company of Body and Capital (Mudharaba): this is where one funds the capital of the business and the other partner works with it. The partner who provides the capital element is a silent partner and takes no part in the running of the business. The other partner buys and sells on behalf of the company.

4. The Company of Reputation (Wujooh): this is a company similar to mudharabah but the capital is provided by a silent partner who has respect and standing and based upon this the company trades. The partner could be a rich merchant, which would mean debts will always be paid by this company as they are backed by a wealthy individual.

5. Company of Negotiation (Mufawadha) this is any combination of the above.

If we study the types of companies allowed in Islam, we will find that some of the criteria for a valid company are as follows:

- There has to be offer and acceptance between the partners.

- The responsibility of running the business rests with at least one of the partners.

- The company and the partners are not separate entities, but a single unit.

- The company is dissolved if a partner withdraws, dies, or becomes insane or incompetent.

- The corporation is not formed by an offer and acceptance amongst the partners. If someone wants to be a shareholder in a corporation, he can simply buy shares of that company and become an owner of the company. The other shareholders do not offer him to join business with them. Nor does he make an offer to the others that the latter accept. Rather, by buying the company’s shares, he voluntarily accepts the terms and conditions of the company and contributes his capital to the company. Hence there is only acceptance and no real offer. For example, when Malcolm Glazer, an American business tycoon, took over Manchester United, he gradually bought out majority of the shares of the club although other shareholders were bitterly opposed to it. Hence, by buying shares, he simply accepted to bind himself to the terms and conditions of the club of his own accord without any of the other shareholders offering him to join business with them.

- In Islamic companies, at least one of the partners is required to be responsible for running the business. He is not allowed to hire someone else to run the company on his behalf. According to western corporate law, the shareholders of a company have no say in managing the business. At most, they can elect the board of directors and they are the ones that manage the company’s day-to-day operations. The shareholders’ decisions regarding the company’s operations are not binding upon the Board of Directors or managers.

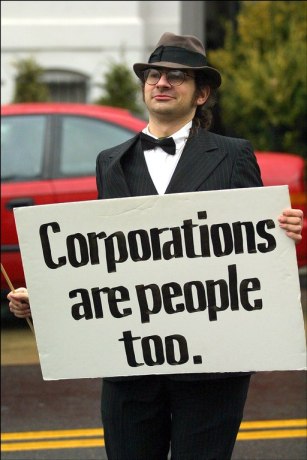

- The capitalist corporations are considered a separate legal entity to that of their owners. So the corporation can buy and sell, sue and be sued, and enter into any different contracts as it likes as though it is a separate person on its own. This allows the shareholders to have limited liability, which means, the shareholders are not fully liable for the company’s debts – they are only liable to the extent of their contribution towards the company’s capital. But in Islam, the company does not have a separate entity to that of its owners. They are one and the same. And it is the owners that buy and sell and enter into contracts for the company, not the company itself as a separate legal entity. Therefore, the owners are liable for the full debt of the company, and cannot escape with just partial liability if the company falls into debt.

- Western corporations have a permanent life and continue to exist even if a shareholder dies or becomes insane or incompetent. In contrast, companies in Islam do not have a permanent life. If any of the partners withdraws, dies, becomes insane or is judged incompetent, the company is dissolved. In the case of a partner’s death, if he leaves behind an inheritor of mature age, he has the choice of either dissolving the company or becoming a partner in the company with the other owners’ consent.

References:

The Economic System in Islam, Taqiuddin an-Nabhani, Hizb ut Tahrir

Companies in Islam: http://khilafah.com/index.php/the-khilafah/economy/1029-companies-in-islam

- Shafi

No comments:

Post a Comment